A Biased View of Google For Nonprofits

Wiki Article

501c3 Organization - The Facts

Table of ContentsThings about Non Profit OrgAbout Nonprofits Near Me5 Simple Techniques For Non Profit Organizations ListThe 7-Minute Rule for Non Profit Organizations Near MeNon Profit Organization Examples Fundamentals Explained6 Simple Techniques For 501c3Not known Details About Nonprofits Near Me A Biased View of Non Profit Organizations List6 Easy Facts About Nonprofits Near Me Described

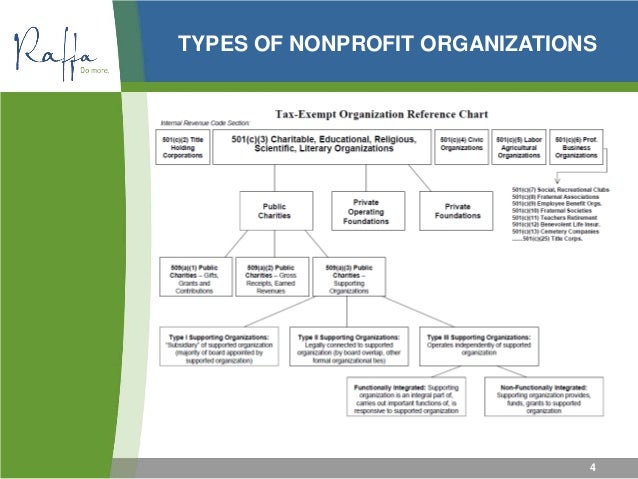

Incorporated vs - not for profit. Unincorporated Nonprofits When people consider nonprofits, they normally believe of bundled nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, and also other formally produced companies. However, several people take component in unincorporated nonprofit associations without ever before recognizing they have actually done so. Unincorporated nonprofit associations are the outcome of two or even more people collaborating for the purpose of giving a public advantage or service.Private structures may consist of family structures, private operating structures, and also company structures. As noted above, they normally don't provide any kind of solutions and instead use the funds they raise to sustain various other philanthropic companies with service programs. Private foundations likewise often tend to need more startup funds to develop the organization as well as to cover lawful charges and other continuous expenses.

The Ultimate Guide To Npo Registration

The possessions continue to be in the count on while the grantor is to life as well as the grantor may take care of the possessions, such as dealing supplies or genuine estate. All possessions deposited into or bought by the depend on remain in the depend on with revenue distributed to the marked recipients. These counts on can make it through the grantor if they include a provision for recurring monitoring in the documentation utilized to develop them.

A Biased View of Irs Nonprofit Search

Additionally, you can hire a trust lawyer to help you create a charitable count on and also advise you on how to handle it progressing. Political Organizations While the majority of various other types of nonprofit organizations have a minimal ability to take part in or advocate for political activity, political organizations operate under various rules.

Not known Facts About Google For Nonprofits

As you review your options, make sure to speak with an attorney to figure out the finest approach for your company and also to guarantee its correct arrangement.There are numerous kinds of not-for-profit companies. These nonprofits are typically tax-exempt because they work towards the general public rate of interest. All possessions as well as income from the not-for-profit are reinvested into the company or contributed. Depending upon the not-for-profit's membership, goal, and also framework, different categories will use. Nonprofit Organization In the USA, there are over 1.

The Buzz on Npo Registration

In the USA, there are around 63,000 501(c)( 6) organizations. Some instances of widely known 501(c)( 6) organizations are the American Ranch Bureau, the National Writers Union, and the International Association of Fulfilling Organizers. 501(c)( 7) - Social or Recreational Club 501(c)( 7) companies are social or leisure clubs. The objective of these nonprofit companies is to organize tasks that lead to pleasure, recreation, and socializing.

See This Report on Non Profit Organization Examples

Common resources of income are subscription dues and also contributions. 501(c)( 14) - State Chartered Credit History Union and also Mutual Book Fund 501(c)( 14) are state chartered lending institution and also mutual get funds. These organizations offer financial services to their participants as well as the community, commonly at discounted rates. Income sources are organization tasks and federal government gives.In order to be qualified, a minimum of 75 percent of members have to be present or past members of the USA Armed Forces. Financing originates from donations and federal government gives. 501(c)( 26) - State Sponsored Organizations Giving Health And Wellness Insurance Coverage for High-Risk Individuals 501(c)( 26) are nonprofit check my source companies developed at the state degree to give insurance policy for high-risk individuals who may not be able to get insurance via other means.

Some Ideas on Non Profit Org You Should Know

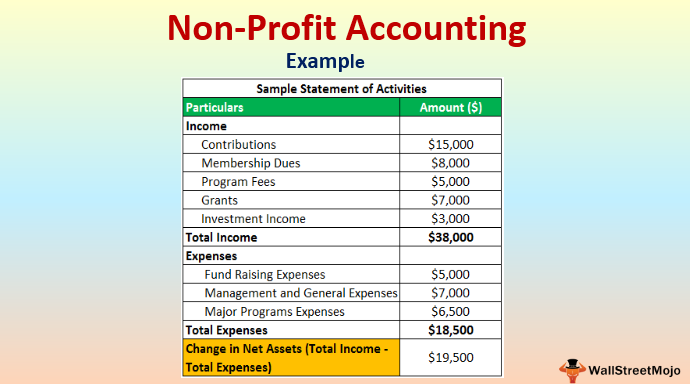

Financing originates from contributions or federal government grants. Examples of states with these risky insurance coverage swimming pools are North Carolina, Louisiana, and also Indiana. 501(c)( 27) - State Sponsored Employee' Compensation Reinsurance Organization 501(c)( 27) not-for-profit companies are produced to give insurance for workers' settlement programs. Organizations that offer employees compensations are needed to be a member of these organizations as well as pay dues.A not-for-profit firm is an organization whose function is something other than making an earnings. nonprofits near me. A nonprofit donates its go to these guys profits to achieve a particular objective that profits the public, rather of dispersing it to shareholders. There are over 1. 5 million nonprofit organizations signed up in the US. Being a not-for-profit does not mean the organization won't earn a profit.

Indicators on Irs Nonprofit Search You Should Know

No person person or team has a not-for-profit. Assets from a nonprofit can be offered, but it benefits the entire company instead of individuals. While anyone can include as a not-for-profit, only those who pass the strict standards official website set forth by the government can achieve tax exempt, or 501c3, condition.We discuss the steps to coming to be a not-for-profit more right into this page.

Facts About 501c3 Uncovered

The most crucial of these is the capacity to get tax obligation "exempt" status with the internal revenue service, which allows it to get donations without present tax obligation, permits contributors to deduct donations on their income tax obligation returns and excuses some of the company's tasks from income tax obligations. Tax obligation excluded condition is essential to many nonprofits as it motivates donations that can be used to sustain the goal of the company.Report this wiki page